- WhaleWire

- Posts

- Bitcoin: The Greatest Scam Never Told

Bitcoin: The Greatest Scam Never Told

For over a decade, Bitcoin has been sold as the future of money — an alleged decentralized revolution free from government and central bank control. But scratch beneath the surface, and a different story emerges: one of manipulation, hidden players, and a market propped up by smoke and mirrors. In this article, I’ll dive deep into the truth behind Bitcoin — a truth that remains largely unknown and rarely reported.

I highly appreciate anyone sharing this with their peers so more people can get a clearer understanding of what they might—or already have—invested in. The full truth needs to be seen, not buried beneath hype and false promises.

The Forgotten Origin: Why Bitcoin Was Really Created

Ask most people what Bitcoin is, and you’ll hear buzzwords like “digital gold,” “inflation hedge,” or “store of value.” Few remember — or even know — that in the whitepaper, Bitcoin was originally pitched as a peer-to-peer payment system designed to bypass banks and financial institutions entirely. That’s what the whitepaper promised: a decentralized currency for daily use, not a speculative asset — which is what it has become today.

Over the years, Bitcoin’s narrative has shape-shifted repeatedly to stay relevant. Each pivot was less about function and more about maintaining the illusion of utility. That’s because most investors don’t care about Bitcoin fulfilling real-world functions — they care about fiat-denominated profits, which is ironic. But forget what the whitepaper says or what Bitcoin investors today claim it’s for. To understand Bitcoin’s true and original purpose, we need to go back to where it all began — even before the whitepaper was released.

Contrary to the widely known January 2009 launch, there’s evidence that an earlier version of Bitcoin existed as far back as April 16, 2008. This pre-release came to light semi-recently, in 2019, when Bitcoin advocate Francis Pouliot shared a long-forgotten version of Satoshi Nakamoto’s original source code — and with it, a glimpse into the creator’s original and true intentions.

The code wasn’t anything related to peer-to-peer payments. It included three surprising features:

An IRC client for bootstrapped communication

A P2P marketplace framework

And most notably, a built-in virtual poker game

Yes — a gambling application was part of Bitcoin's DNA from the start.

Why did the original Bitcoin code include remnants of a poker gambling framework? It’s not just a quirky detail — it points to a deeper, overlooked truth: Bitcoin didn’t emerge from some pure monetary ideal.

The early code suggests Bitcoin may have started as an experiment in unregulated digital exchange — potentially even tied to gambling — rather than a serious plan to replace fiat. That context matters. It shows that the project wasn’t born from economic genius but from a chaotic mix of ideology, opportunism, and internet counterculture. This is what I believe was the true reason Bitcoin was created. As a currency for poker gambling — a way to move money quickly and anonymously in an unregulated space, not some revolutionary tool to upend global finance.

People like to romanticize Bitcoin’s origins, but the reality is clearly so much murkier. The inclusion of gambling hooks in the code exposes how improvisational and inconsistent the early vision was. Bitcoin wasn’t a clean solution to a clear problem — it was a prototype patched together in a moment of financial and political disillusionment. And the fact that those traces still exist says more than any whitepaper ever could.

Another key question that few ask is: why did Satoshi cap Bitcoin at exactly 21 million? People toss around theories — math, inflation control, mining schedules — but anyone who's spent time around a casino sees it for what it is: blackjack.

In blackjack, 21 is the holy grail — the perfect hand, the unbeatable number. Hit 21 and you win. Go over, and you’re out. To the average person, 21 million is just a random cap — arbitrary, meaningless. But to someone like Satoshi, it wasn’t. It was symbolic. It’s very clear on how bitcoin was built that he wasn’t just a coder. He was a gambler at heart. This isn’t some conspiracy, the code literally has poker logic and blackjack mechanics. Additionally, the name "Satoshi" in Japanese can mean "wise" or "quick-witted," qualities often attributed to skilled gamblers.

Now imagine a bank launching something called “Roulette Savings” or “Casino Bonds.” You’d laugh — or run. But Bitcoin pulled it off, because those now controlling the narrative tried hiding the original source code by scrubbing it from old bitcoin threads, and by creating new made-up narratives like “inflation hedge” or “store of value”. It wrapped a high-stakes gamble in ideology, cryptography, and anti-establishment polish. The bet was genius and disguised as a breakthrough.

What’s more, those gambling references in the code? Quietly removed by Satoshi in later versions. No explanation. No comment. Just gone. It’s one of the most overlooked parts of Bitcoin’s origin story — and maybe the most revealing.

The Connection of Gambling & Bitcoin.

In the early 2000s, online poker exploded into a multi-billion-dollar industry, but it was a legal minefield. Sites like Absolute Poker and Ultimate Bet processed hundreds of millions of dollars annually, yet they faced relentless government crackdowns. In 2006 and 2007, authorities froze millions of dollars in player funds, and several executives were indicted for fraud and money laundering. Players often had their accounts frozen, losing access to their winnings overnight.

This chaos created a massive problem: how do you move large sums of money anonymously and quickly without banks or regulators stepping in? Enter Satoshi. Almost certainly connected to this gambling scene, Bitcoin was engineered as a solution to these issues. It allowed poker players to deposit, withdraw, and transfer funds instantly without banks blocking transactions or governments freezing assets.

Satoshi was likely exploring the potential of Bitcoin as a means to facilitate online gambling, particularly in light of the 2006 Unlawful Internet Gambling Enforcement Act (UIGEA), which restricted financial institutions from processing payments related to online gambling. I believe Bitcoin was created for the sole purpose of being a workaround for such regulations .

By 2011, online poker was already feeling the heat from tightening regulations and payment processors cutting ties. Bitcoin offered an escape hatch — a way to keep the money flowing in the shadows. But no one could say that in the whitepaper, because openly admitting Bitcoin was built to serve the gambling underworld wouldn’t sell as a revolutionary financial breakthrough.

The first people who grabbed Bitcoin were almost certainly poker gamblers. They started by using it to play, winning and doubling stacks quick. Then they realized Bitcoin was more than just a tool for poker gambling — it was a way to make insane profits. They started holding it, hyping it, turning it into an asset to attract investors and cash in on the hype.

Even the first ever Bitcoin companies were tightly linked to online gambling. Take SatoshiDice, one of the earliest and biggest Bitcoin gambling sites, which made millions in bets and helped spread Bitcoin’s use early on. BitPoker also surfaced fast, proving the poker crowd was front and center in Bitcoin’s rise. But both sites eventually faded—SatoshiDice was shut down after a legal crackdown, and BitPoker disappeared into obscurity amid regulatory pressure and competition. Their rise and fall underscore how deeply Bitcoin’s origins are intertwined with high-risk, speculative ventures, a theme that echoes through the industry’s history and still colors its reputation today.

Now, look at all of the key figures who came from or were deeply connected to that gambling world and later became some of the early top supporters of Bitcoin:

Roger Ver — Known as “Bitcoin Jesus,” Ver got his start heavily involved in online poker and libertarian tech circles. He was an early adopter who used Bitcoin to fund and grow gambling-related ventures. His belief in Bitcoin as a way to escape government control was shaped by his frustration with the legal and financial restrictions poker players faced. Ver’s aggressive promotion of Bitcoin and early investments in gambling-related crypto startups helped turn Bitcoin into a mainstream asset and sparked the ICO boom.

Mark Karpelès — Before becoming CEO of Mt. Gox, the world’s largest Bitcoin exchange at the time, Karpelès was involved in the gaming and gambling scene online. Mt. Gox originally started as a company called ‘Magic: The Gathering card exchange’ but quickly shifted to Bitcoin, which was widely used for online poker deposits and withdrawals. His role in managing massive volumes of Bitcoin transactions linked closely to gambling made him a central figure in early crypto liquidity and exchange infrastructure.

Samson Mow — Former Chief Strategy Officer at Blockstream, associate at Tether and a vocal Bitcoin advocate, Mow grew up around gaming and online payment ecosystems that often intersected with gambling. He’s been a loud voice pushing Bitcoin as a way to undermine traditional financial gatekeepers, resonating with the poker crowd that first used Bitcoin to dodge banks and regulators.

Charlie Shrem — One of the clearest links between online poker and Bitcoin, Shrem was deeply involved in the underground gambling payment scene before founding BitInstant, one of the first ever Bitcoin exchanges. He openly admitted Bitcoin’s appeal to gamblers looking for fast, untraceable transfers without the risk of frozen accounts. His early work helped build Bitcoin’s infrastructure and community, making him a foundational figure in crypto.

Let’s be honest… Bitcoin was created for gamblers — and the people who first adopted it prove that point. The fact that the first eight Bitcoin exchanges were all branded with poker themes isn’t some random coincidence. Nearly every early adopter had a lengthy history in gambling.

Speculative trading — what Bitcoin has become today — is just another form of gambling, pure and simple. It’s not some magical “store of value” or revolutionary monetary system. Let’s be honest: it’s a high-stakes game fueled by hope, hype, and blind faith, exactly like the gambling roots it sprang from.

Even the biggest supporters, like Michael Saylor, have connected the dots and acknowledged Bitcoin’s roots in online poker gambling—and he’s right to warn that Bitcoin could suffer the same fate. What the original creators never seemed to grasp, though, was that poker gambling itself was a massive bubble. When that bubble burst—due to legal crackdowns, drying up payment options, and shifting public interest—that collapse forced Bitcoin’s architects to pivot. They twisted Bitcoin from a gambler’s workaround into this overhyped “peer-to-peer currency” fantasy. Everyone who’s been paying attention knows how badly that’s failed. The original promise was already dead on arrival, buried under layers of speculation and myth-making once the poker bubble popped.

What Caused Bitcoins Historic Growth?

Bitcoin’s meteoric rise wasn’t a fluke or purely technological marvel—it was driven by a perfect storm of factors. Early adoption by online gamblers seeking anonymous, instant payments laid the groundwork. Speculative mania, fueled by hype and the promise of outsized returns, attracted waves of investors hungry for quick gains. Key figures and exchanges rooted in gambling culture helped bootstrap liquidity and awareness. Meanwhile, narratives of decentralization and freedom from banks captured the imagination of libertarians and tech enthusiasts alike. Combine this with loose regulation, media frenzy, and institutional dabbling, and you get a volatile yet explosive growth trajectory — one built more on emotion and speculation than fundamental value.

In Bitcoin’s early days, the price mostly moved naturally — driven by miners and poker gamblers trading actual value. But as the bubble grew, it attracted a darker crowd.

Take Silk Road, the infamous darknet marketplace launched in 2011. It turned Bitcoin into the currency of choice for illegal drug sales and other black-market deals. This wasn’t some fringe use case; it put Bitcoin on law enforcement’s radar and tainted its reputation early on.

Then there were scams like Mt. Gox. Originally a “humble” Bitcoin exchange, like they all (even the current big ones) pretend to be, it grew too fast and poorly managed funds — eventually exit-scamming about 850,000 BTC in one of the biggest crypto collapses ever. Mt. Gox showed how early players with questionable ethics could wreck the space.

There were also dozens of high-profile frauds like Bitconnect, though it came later, it followed the same pattern: promise huge returns, build hype, then collapse and vanish with investor money.

As Bitcoin grew beyond just gamblers and black markets, bigger players stepped in to “professionalize” the ecosystem. Two of the most significant—and controversial—names to emerge were Blockstream and Tether. These are a key focus on the explosive growth that Bitcoin has seen, and are the main actors behind this unprecedented fraud scheme.

Blockstream: The Gatekeeper of Bitcoin’s Future

Blockstream, founded in 2014, branded itself as the cutting-edge force behind Bitcoin’s scaling and development. Its self-proclaimed innovation, the Lightning Network (LN), was promoted as the solution to Bitcoin’s well-known issues with speed and scalability, promising near-instant, low-fee transactions off the main blockchain. On paper, it sounds like the perfect upgrade.

But here’s the ironic part: Satoshi Nakamoto, Bitcoin’s creator, explicitly warned against building Bitcoin’s functionality on top of complex, third-party networks that introduce new layers of trust and potential centralization. The Lightning Network is exactly that—a second-layer solution that requires users to trust intermediaries and hubs to route payments. This fundamentally conflicts with Bitcoin’s original promise of trustless, peer-to-peer money without gatekeepers.

In practice, Blockstream’s heavy influence over Lightning’s development and infrastructure means they have become de facto gatekeepers. This centralization concentrates control over Bitcoin’s network in the hands of a few powerful players, undermining the decentralized ethos that Bitcoin was built on. Instead of empowering individuals, the Lightning Network—and by extension Tether/Blockstream—shifts power toward institutional interests, developers, and large financial entities, sidelining the average user.

This clash between the original vision of Bitcoin as censorship-resistant, borderless money and the realities of Blockstream’s Lightning Network reveals a bitter irony: solutions marketed as “scaling” Bitcoin often end up making it less decentralized and more vulnerable to the same systemic risks Bitcoin was designed to escape.

In 2015 and 2016, a critical battle erupted over Bitcoin’s block size—the limit on how much transaction data fits in each block. Bitcoin was initially designed to allow larger blocks to support high transaction throughput, fulfilling its role as a peer-to-peer digital cash system. But Blockstream pushed to keep blocks deliberately small—not out of technical necessity, but to restrict Bitcoin’s on-chain capacity. This throttled transaction speed and increased fees, pushing users toward off-chain solutions like the Lightning Network—networks Blockstream effectively controls. The result? Bitcoin’s original promise of fast, cheap payments was sacrificed, turning it into a limited settlement layer that mainly benefits institutional players while locking out everyday users.

The story gets even more revealing when you learn that Blockstream was founded by Adam Back—a Bitcoin maximalist and one of the very few individuals named in the original Bitcoin whitepaper. Back was deeply involved from the start, having extensive early communications with Satoshi Nakamoto. His influence has been crucial in steering Bitcoin’s future direction.

Tether: Gambling Roots and Market Manipulation

Then there’s Tether—the first-ever stablecoin, launched in 2014. It promised a digital dollar, pegged 1:1 with the USD, to bring stability to the chaotic crypto markets.

Tether was co-founded by Craig Sellars, but the real inspiration—and a key figure tied to its origins—is J.R. Willett. Willett is notorious in poker circles for his online gambling ventures before transitioning into crypto. His experience navigating the murky, legally risky world of online poker—where moving money quickly and anonymously is essential—fed directly into his grand idea of a stablecoin that could manipulate crypto trading dynamics.

Willett’s gambling background wasn’t just a footnote. Poker pros like him mastered operating in gray zones, exploiting loopholes, and keeping funds flowing under the radar—exactly the skill set a stablecoin needed to survive and thrive in crypto’s wild early days.

But Willett’s impact didn’t stop there. He also created the ICO (Initial Coin Offering) model, essentially copying the hype-driven formula of IPOs from the traditional stock market—especially after the dot-com busts of the early 2000s and 2008, which showed how investor mania drives bubbles. Willett understood that fueling Bitcoin’s explosive growth required mimicking this frenzy, spawning thousands of new cryptos and unprecedented attention to the space. For those not around back then, it was probably the biggest orgy of fraud and scams ever—exit scams happened daily, with countless investors losing everything chasing hype.

The Shadowy Side of Tether and Bitfinex

Tether’s shadow runs deeper than gambling ties. The company behind it, iFinex—which also owns Bitfinex, one of the largest crypto exchanges—has faced repeated accusations of shady dealings.

A major figure here is Giancarlo Devasini, an Italian surgeon turned Bitfinex CFO, linked to numerous allegations of fraud and financial mismanagement. Documentation reveals suspicious fund movements, alleged bank frauds, and obfuscation tactics used by Tether and Bitfinex to hide massive losses and misrepresent reserves.

Devasini’s murky role in shifting funds across offshore accounts and the tangled web of banking relationships Bitfinex has struggled to maintain paint a clear picture of a company operating far from transparency or legal standards. His involvement exposes how deeply the rot runs in the crypto stablecoin world, reinforcing the connections between shadowy financial schemes and the wild west mentality of online gambling that helped shape Bitcoin’s early ecosystem.

Notably, a leaked SoundCloud audio recording reveals Bitfinex executive Zane Tackett admitting that Tether was one of four seed investors in Blockstream (and ShapeShift), showing just how intertwined these key players are.

How Tether Created the Largest Market Bubble, and Fraud Scheme in History.

When Tether was first created, they claimed to be backed 1:1 with the US Dollar, but to date, there is not a single shred of evidence that supports their claims. Tether hasn’t had any audits, and refuses to show its reserves, which are hidden in shady offshore bank accounts.

Bitcoin maximalists, who loudly claim to champion decentralization, are always the first to defend and cover up Tether’s lies. They do this because they know the whole Tether fraud depends on their support. Tether has only ever done one attestation, which these maxis love to parade as an “audit.” Anyone with a basic understanding knows it’s not even close. It’s basically just someone signing off on an Excel sheet—no detailed, verifiable findings, no real proof.

Over the years, skepticism around Tether’s legitimacy morphed into outright suspicion—and investors finally started demanding accountability for the web of lies Tether spun. The rumors that Tether isn’t fully backed struck a serious blow to its carefully crafted image, forcing the company to scramble for damage control.

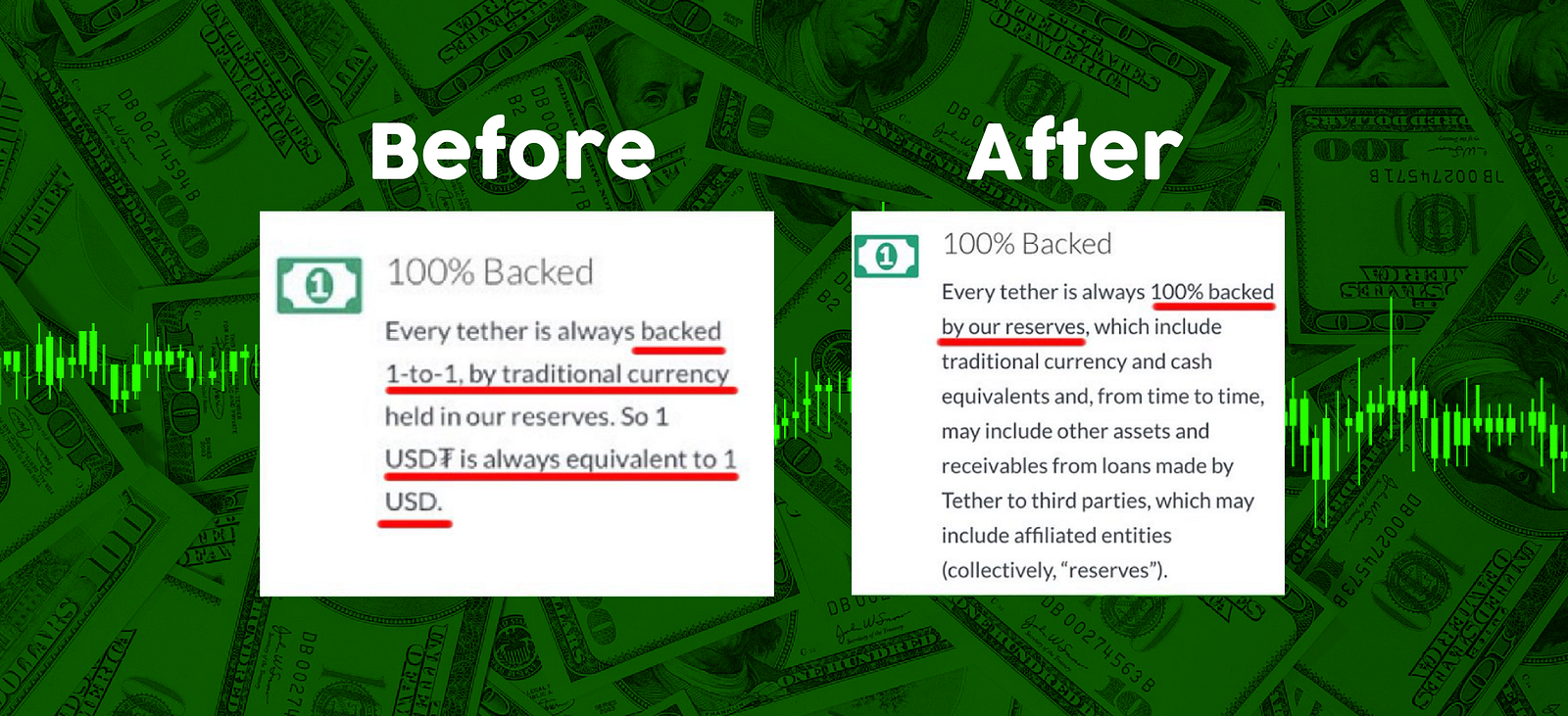

In 2019, instead of coming clean, Tether begun its campaign of lies, and quietly rewrote its website, swapping its original bold claim of being “backed 1-to-1 with USD” for a deliberately vague and misleading phrase: “100% backed by our reserves.” Reserves that remain a complete black box—unverified, undisclosed, and conveniently hidden from public scrutiny. It wasn’t a correction; it was a strategic cover-up, designed to keep the illusion alive while dodging real transparency.

A study from two reputable scholars found that Bitcoin’s famous rise to $20,000 in 2017 was mainly caused by the injections of Tether. The injections came directly from a single holder on the Bitfinex exchange, which also happens to be owned by iFinex, the same people who own Tether limited.

This is how the scheme works. By minting Tether (USDT) out of thin air, they create an artificial surge in demand that pulls real (mostly retail traders) into the market, driven by FOMO. For example, imagine Tether printing $1 billion in new USDT tokens out of thin air and flooding the market. That’s fake liquidity, not real money, yet it creates the illusion of increased buying power. Investors see Bitcoin’s price rising—sometimes 10%, 20%, or more—and rush in with actual cash, fueling a buying frenzy.

When you track Tether’s printing history against Bitcoin’s price movements, a clear pattern emerges: Bitcoin tends to spike sharply whenever Tether mints large amounts and then often drops when the printing stops. The phantom billions from Tether create fake buying pressure that lures real investors into chasing gains on an inflated, unstable market. It’s a textbook pump-and-dump scheme, powered by counterfeit money.

A 2020–2021 study clearly showed Tether printing unprecedented amounts of “fake dollars,” far exceeding anything before. This flood of unbacked USDT wasn’t just coincidental—it directly fueled Bitcoin’s explosive surge past $40,000, and even todays surge above $100,000 The popular narrative that “institutional demand” drives these price spikes is a smokescreen; institutions make up less than 10% of the market.

Tether defenders claim they only print new tokens to meet genuine demand. But a quick look at Tether’s market cap and printing timeline exposes this as nonsense. There were multiple months with no new Tether minted—meaning, by their logic, no Bitcoin demand—yet prices kept moving wildly. This pattern proves Tether’s printing doesn’t align with real market forces but is a deliberate tool to manipulate prices. And this manipulation isn’t history—it’s happening now, with even greater intensity.

2017–2021 Tether Printing Record (JacobOracle)

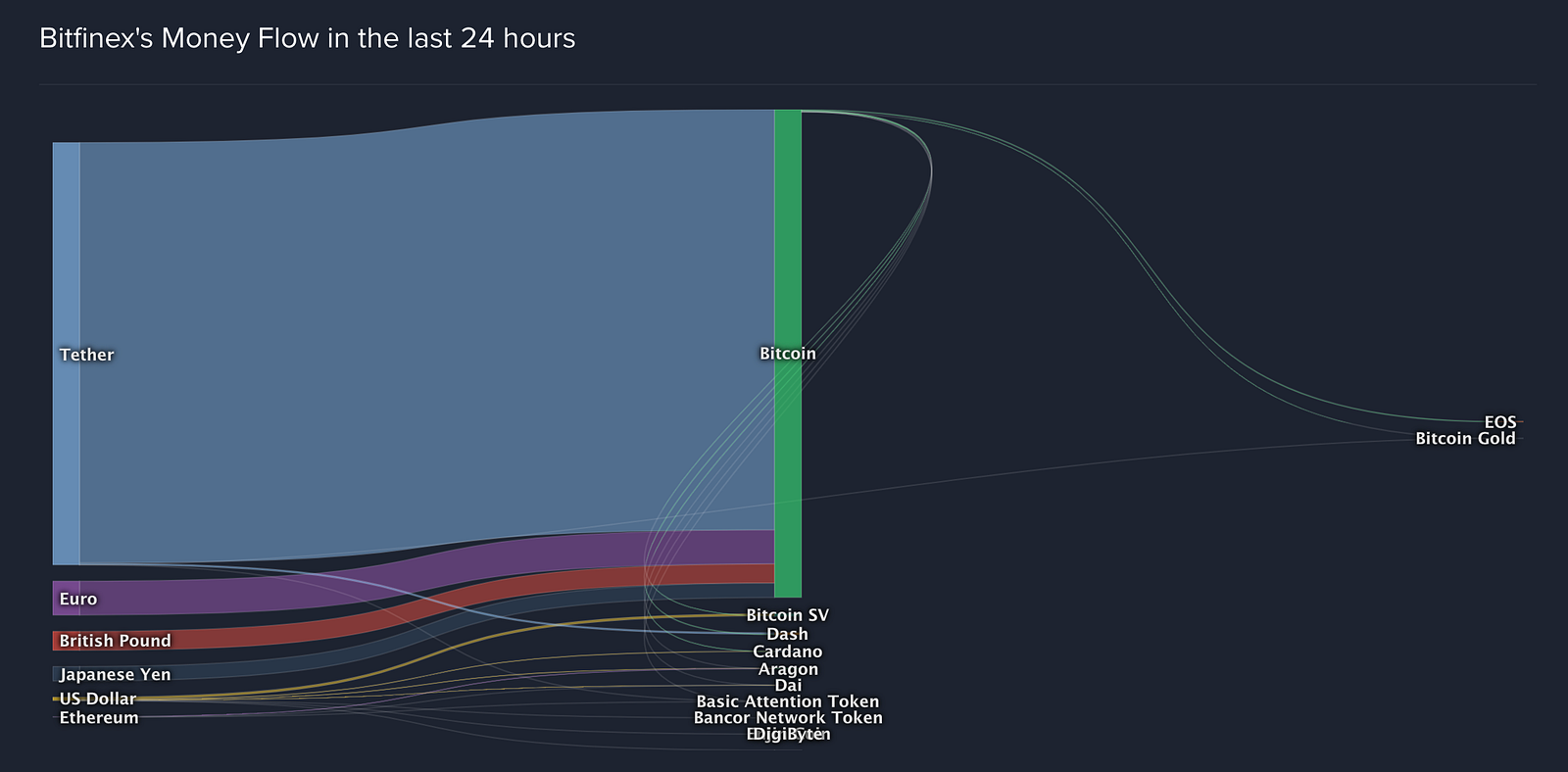

The majority of funds flowing into Bitcoin is from Tether.

Tether dominates trading volume on major exchanges like Bitfinex, Binance, Poloniex, and Bittrex. For example, nearly 75% of all volume on Bitfinex—Tether’s own exchange—is conducted in USDT. This isn’t a small detail; it’s the backbone of Bitcoin’s market activity.

Blockstream and the Lightning Network are trying to replicate the existing financial system’s structure—centralized, controlled, and layered with intermediaries. But unlike the U.S. government-backed dollar, Bitcoin and its ecosystem have zero real backing. The Federal Reserve is backed by the largest military in history, a massive, productive economy, and corporate giants that generate real goods and services. Bitcoin? It’s backed by nothing tangible, just speculative belief.

The moment regulators shut down Tether or expose its fraud, Bitcoin’s price will crater. The popular myth that “holders will just swap USDT for Bitcoin and BTC will soar” is naive at best. When Tether’s house of cards falls and stablecoin regulations hit, it won’t just break Tether’s peg—it will shatter Bitcoin’s fragile market as well. This happens because the entire crypto market has been propped up by fake, counterfeit dollars masquerading as real liquidity.

Bitcoin trading above $100,000? That’s a fantasy propped up by fake money. When confidence evaporates, the ensuing panic and sell-off will dwarf every crash the market has seen before, turning the crypto empire into rubble overnight.

New York Attorney General: Bitfinex and Tether Investigation

Forget the speculation and rumors—let’s focus on what the courts say. Spoiler: they call it fraud too.

In 2019, the U.S. District Court filed a massive lawsuit against Bitfinex, Tether, and Poloniex, accusing them of running a colossal price manipulation and fraud scheme in the crypto markets. Bitfinex has denied these claims for years and fought hard to dismiss the $1.4 trillion investigation, knowing full well it would expose their fraudulent operations.

Tether’s own admissions reveal the truth.

In a signed affidavit, Tether’s lawyer admitted the stablecoin was never backed 1:1 by the dollar. Instead, they only had reserves covering about 74% of the issued tokens. After years of insisting they were fully backed, Tether was cornered and forced to make this admission to avoid harsher prosecution and keep their scheme alive longer.

This confession alone should have been a massive red flag to any investor—they were misled for years. On top of that, one of Tether’s lawyers accidentally revealed they were using reserves to buy Bitcoin, confirming suspicions that Tether was fueling the crypto market artificially.

The Offshore Engine Room: Centralized Crypto Exchanges — The Real Puppet Masters

While Bitcoin maximalists rave about decentralization, the truth is a small group of offshore centralized exchanges run the entire show, churning fake volume and laundering billions in dirty money. Leading this rot are Binance and FTX—but they’re far from the only bad actors.

Binance, the world’s biggest crypto exchange by volume, operates in regulatory no-man’s land, with no fixed HQ and near-zero oversight. It handles up to 70% of all Tether trades—Tether itself a stablecoin shrouded in opacity and questionable backing. Binance isn’t a neutral trading venue; it’s the engine pumping artificial demand. Investigations uncovered Binance laundering over $2.35 billion linked to darknet markets, scams, and sanctioned entities. CZ’s regulatory dance kept a clean public image while enabling a systemic scam.

FTX was the so-called “clean” institutional exchange, founded by Sam Bankman-Fried (SBF). Marketed as an ethical alternative, it turned out to be a house of cards. FTX funneled user deposits to Alameda Research, its hedge fund sibling, using massive Tether loans to rig markets. Its collapse wiped out billions in customer assets, and Binance immediately swallowed much of its market share, tightening the chokehold on an already fragile market.

But don’t kid yourself—this isn’t just about CZ or SBF. They’re the poster children for a rigged system where every major exchange plays the same game under different branding. Bitfinex, for example, is a chronic offender with decades of scandals and a central role in market manipulation. Coinbase? They play the “clean” game but have been caught orchestrating wash trading and other shady tactics to inflate volumes. Bybit, KuCoin, Celsius—names synonymous with opaque practices, sudden collapses, and user fund mismanagement.

History screams warnings—Mt. Gox’s meltdown, Celsius freezing withdrawals, Voyager and BlockFi going bust, Bitfinex’s repeated scandals, and the recent FTX disaster. Yet retail holders keep trusting these centralized entities like sacred cows.

Here’s the brutal truth: centralized exchanges are not markets; they’re offshore laundromats and insider exit ramps disguised as innovation hubs. They inflate fake volume with Tether-fueled leverage and disappear with user funds at the first sign of trouble.

El Salvador’s Bitcoin Scam: A Manufactured Illusion

Bitcoin maxis love parading El Salvador as proof that "the world is adopting Bitcoin." It’s their favorite propaganda piece to lure in retail bagholders with the fantasy that global governments are rushing to embrace BTC. But here’s the truth: it's a complete sham.

To date, El Salvador is the only country to ever make Bitcoin legal tender, and as expected, it imploded—exactly as I predicted. The rollout was a disaster, not a revolution. There was no organic demand, no citizen-led adoption—just a top-down scheme fueled by corruption, hype, and fraud.

Behind it all? Tether. As always. The same shady operation tied to offshore accounts, market manipulation, and counterfeit liquidity. Tether didn’t just influence El Salvador’s Bitcoin law—they wrote the damn bills. They bribed President Nayib Bukele, plain and simple. In return, Tether got a safe haven to avoid U.S. prosecution, dodge taxes, and launder legitimacy. Bitfinex (Tether’s sister company) even moved their HQ to El Salvador, and suddenly became the engine behind scammy volcano bonds, daily BTC purchases, and the entire fake narrative of government-level Bitcoin adoption.

Notice how none of the Bitcoiners ever mention El Savlador anymore? It’s because new blockchain data proved El Salvador never even bought any Bitcoin. Of the 6,114 BTC the government claims to hold, 6,111 were transferred directly from Bitfinex and Tether wallets. There was no buying. No investment. No market pressure. Just a backroom ledger shuffle to create the illusion that a country was going “all-in.”

This wasn’t a national policy—it was a liquidity laundering stunt designed to manipulate sentiment. Bukele got international headlines. Bitfinex moved fake coins off their books. Tether bought time to keep their fraud running. Everyone won—except the people.

Oh, and remember the Chivo Wallet? The government’s shiny new BTC wallet app? It effectively went bankrupt and shut down, with usage collapsing by 98.9% within months of launch. Turns out, nobody wanted to actually use Bitcoin for anything. Not even Tether’s cartel could prop it up.

This wasn’t adoption. It was a marketing scam by Tether and Bitcoin insiders disguised as a monetary revolution. El Salvador was never a sovereign player in this. It was a pawn.

Jack Mallers: The Poster Boy of a Manufactured Bitcoin Narrative

Jack Mallers has been marketed as the fresh-faced savior of Bitcoin payments—young, loud, hoodie-wearing, and “changing the game” with his company, Strike. But peel back the branding, and what you find is a deep entanglement with the very cartel keeping the crypto scam alive: Tether, Bitfinex, Blockstream, and iFinex.

Strike isn’t some independent fintech disruptor. It’s owned by Blockstream—yes, the same Blockstream that launched the Lightning Network, centralized Bitcoin development, and actively pushed Bitcoin away from being a usable peer-to-peer currency. So while Mallers yells about “Bitcoin for the people,” he’s directly tied to the exact players who neutered Bitcoin’s original vision.

His relationship with iFinex (the parent company of Tether and Bitfinex) runs deep. His newer venture, Twenty One Capital, claimed to be flush with investment capital—but on-chain data exposes that over 14,000 BTC, worth more than $2 billion, came directly from Tether’s reserves. Not investors. Not market interest. Just internal liquidity games.

They claim overwhelming demand. But outside of Tether’s phantom cash, there’s no evidence anyone is actually investing. This isn’t a growth story—it’s a shell game.

Strike is no better. Despite all the hype, actual adoption is nearly nonexistent. The platform runs entirely on Tether infrastructure. Every “Bitcoin” transaction is just USDT moving behind the curtain. It’s not decentralization—it’s a closed, permissioned system disguised as innovation.

Mallers is the poster boy for a false narrative, deployed to sell the dream of Bitcoin adoption while insiders move fake money around and drain real liquidity from unsuspecting believers. He’s not disrupting the system—he’s working for it.

Michael Saylor: The Dot-Com Loser Turned Bitcoin Cult Leader

I’ve dug into Michael Saylor’s past, and the parallels with what he’s doing today are hard to ignore. In 2000, during the dot-com bubble, Saylor was caught inflating MicroStrategy’s financials. The SEC launched an investigation, and the company had to restate its earnings, wiping out over $11 billion in market value. MicroStrategy’s stock collapsed by 99.99%. Time Magazine and CNN labeled him the biggest loser of the dot-com crash. That’s not an opinion—it’s documented.

Now, two decades later, he’s doing it again, only this time using Bitcoin.

Look at the structure: MicroStrategy raises capital—mostly through debt and stock offerings—buys Bitcoin, and then uses that inflated asset on its balance sheet to justify raising even more capital. This is not a business strategy. It’s a circular trade, and it closely mirrors the same financial engineering that destroyed MicroStrategy the first time around. I’ve titled this the ‘Reflexive Ponzi Loop’ scheme, which is illustrated below.

People think he’s making a bold bet. But if you check the numbers, MicroStrategy is now one of the most overleveraged companies on the Nasdaq, entirely dependent on Bitcoin’s price staying high. If Bitcoin drops significantly, the company’s balance sheet falls apart.

And here's what really stood out: despite Tether’s long-standing reputation issues—lack of audits, questionable reserves, SEC scrutiny—Saylor never mentions it. Not once. No questions. No concern. That’s not just strange; it’s telling.

Because the truth is, the majority of Bitcoin’s market liquidity is propped up by Tether. And Saylor knows it. If Tether collapses, Bitcoin tanks, and so does MicroStrategy. His silence isn’t ignorance. It’s protection. He needs the illusion of stability to keep this whole thing going. This isn’t about sound money or long-term conviction. It’s about leverage, price manipulation, and keeping up appearances while retail investors take on the risk he created.

And just like in 2000, when the music stops, he won’t be the one left holding the bag.

“If Bitcoin’s a Scam, Why Are Such Big Players Involved?”

The common rebuttal of Bitcoin is simple: “If it’s a scam, why are trusted institutions like BlackRock and Fidelity getting involved?” The answer is just as simple: greed.

These players are not a moral compass. Blackrock, as an example, is an asset manager with a fiduciary duty to chase yield wherever it can be found. When Bitcoin prices were ballooning—pumped by Tether and offshore leverage—BlackRock saw an opportunity to create fee-generating products like ETFs. They're not buying Bitcoin because they believe in its fundamentals; they’re packaging it to sell to you—to pension funds, retail investors, and anyone late to the party. This is the same playbook used in the subprime mortgage crisis. Once again, the smart money is selling the illusion of value to the greater fool. They create complex instruments and hype narratives to mask underlying rot, offloading risk onto unsuspecting retail investors while quietly cashing out. Meanwhile, the system inflates beyond sustainable levels—until it crashes, leaving millions burned and billions wiped out. Greed blinds the masses, and history repeats itself because no one wants to face the hard truths hiding beneath the glitter.

Let’s not forget: Theranos, an infamous scam company, was onced backed by former Secretaries of State, billionaires, and blue-chip venture funds. Bernie Madoff chaired NASDAQ. WeWork, Wirecard, Luna, and FTX all had the backing of prestigious institutions or public trust at some point. None of that prevented collapse. Being big doesn’t mean being right. Often, it just means you're in a better position to offload the risk before the truth hits.

In crypto, no one is asking hard questions. Where are Tether’s real audits? Why do the same five market makers dominate volume on every exchange? Why does the price of Bitcoin remain stable even when there's no net inflow of USD? The red flags are all there—but greed has blinded investors, regulators, and journalists alike. Everyone’s incentivized to play along until the music stops.

The involvement of BlackRock is not a vote of confidence—it’s a sign we’re in the final inning of the grift, where the insiders are packaging toxic sludge into shiny ETFs and handing it off to retail before the floor gives out. This isn’t investment—it’s exit liquidity.

What’s Next for Bitcoin?

Like every scam before it, this whole house of cards will collapse. There are already dozens of cracks spreading through the system. Frankly, it’s a miracle the Bitcoin puppet masters managed to build such a massive industry by exploiting human emotion, and credit where it’s due—they deserve applause for that hustle. But make no mistake: millions of investors will be burned when the façade crumbles.

Exchanges will freeze withdrawals. The media will scream crisis. Tether will come under federal raids. Bitcoin will plummet. Its true value? Far below $10,000. In fact, anyone reading this, I guarantee there’s a 99% chance it will dive far beneath that mark. Unlike Bitcoin maximalists clinging to wishful thinking and the “greater fool” theory, I’ve done the actual research. I used to be a massive Bitcoin bull and profited from its historic rise—but I also did my research and woke up to the truth. This is all a ticking time bomb.

My warnings aren’t fearmongering—they’re to help the few stragglers who care about their money and want to see things clearly.

The future looks like this: governments will introduce stablecoin regulations. Banks will flood in with their own government-backed stablecoins, promising safety and control. Slowly, central bank digital currencies (CBDCs) will become the norm, effectively turning crypto into a government-controlled system.

Just like the dot-com bubble wiped out 94% of those companies, Bitcoin’s massive scam will implode. But that doesn’t mean the entire blockchain space is worthless. Coins with real utility—like Ripple for payments, Ethereum with its robust app ecosystem, or projects integrating AI—do hold value. However, their worth is far lower than current market caps suggest. That’s why the entire crypto industry is vulnerable.

This collapse isn’t just a possibility. It’s an inevitability. And those who ignore this warning will pay the price — because when the house falls, there won’t be any floors left to catch you.

If you found this article valuable, please consider subscribing to my newsletter. It takes a lot of time and effort to dig up and share these hard truths, and I rely on support from readers like you to keep this work alive. Your engagement means more than you know—thank you deeply for standing with me in seeking the real story behind crypto.