- WhaleWire

- Posts

- Gold Quietly Surpasses the Magnificent 7 as Wall Street's Most Crowded Trade – Here's Why

Gold Quietly Surpasses the Magnificent 7 as Wall Street's Most Crowded Trade – Here's Why

Gold Soars as Safe Haven Amid Global Market Shifts

Welcome back!

We’re excited to share that we’ve now surpassed 250,000+ subscribers—thank you for being part of this growing community. A warm welcome to our new readers!

Here’s what we’re covering today:

📉 Recession fears are spiking

📉 US bonds are losing their shine

📈 Gold is quietly becoming the world’s most in-demand asset

🌍 Central banks are saying one thing—and doing another

If you’ve been watching the headlines, you know the mood’s shifted. Global recession alarms are ringing louder than they have in over a decade. On the surface, it’s easy to point fingers at the usual suspects: inflation, Trump-era tariffs, or post-pandemic money printing. But the truth is, this storm has been brewing for years.

Markets are cracking. Stocks, crypto, real estate, commodities—you name it—have all taken a hit. But one asset has quietly broken away from the wreckage, climbing steadily to all-time highs and now crowned the most crowded trade in the market: gold.

🚨 Earlier today, Gold hit a record high over $3,333/oz

According to Bank of America’s latest fund manager survey, 49% of managers say “long gold” is now the most crowded trade on Wall Street. That’s the first time in two years it hasn’t been tech darlings like the “Magnificent Seven.” Translation: even the suits are quietly sprinting for safety.

Let’s rewind. Back in 2020, stocks and gold were neck-and-neck, but equities pulled ahead. Then came inflation. Then interest rate hikes. Then a bear market.

Flash forward to today? Money is flooding back into gold like it’s the only seat left on the lifeboat. And honestly—it might be. Check out this chart from Bloomberg which shows Gold Vs. S&P 500.

The reason this is happening? Well, most mainstream coverage won’t say, but the answer is that: US bonds have lost their halo.

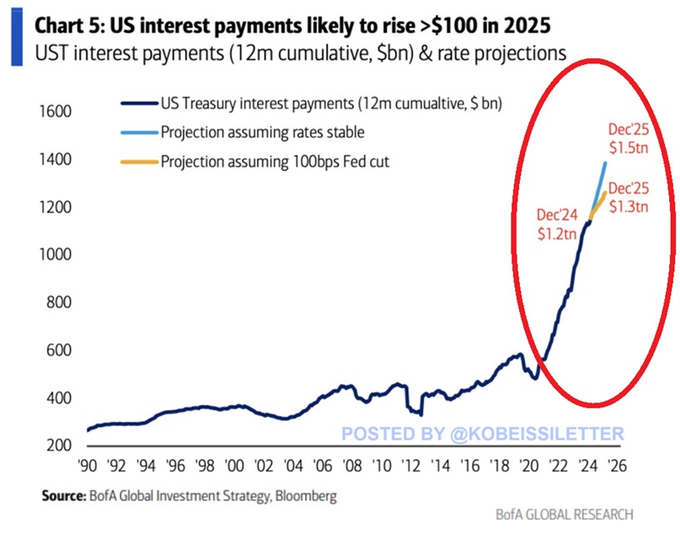

Washington’s interest payments on debt just hit a whopping $1.2 trillion in the past 12 months. To keep funding this deficit, the US has had to FLOOD the market with Treasuries—$23 trillion worth in 2023 alone. Basic supply and demand: more bonds, lower prices. And suddenly, what used to be the world’s safest asset is starting to look… not so safe.

The bond flood no one’s talking about

In just three months of 2023, the US government issued nearly $7 trillion in Treasuries. By year-end, that number ballooned to $23 trillion—an issuance pace we've never seen before. And 2024? The firehose hasn’t stopped.

The original US-China trade war in 2019 felt chaotic at the time. But what we’re seeing now makes that look like a warm-up. The Economic Policy Uncertainty Index—a key gauge of investor anxiety around government decisions—has surged to its highest level ever recorded. And it’s not even close. We’re talking levels 3 times higher than during Trump’s first trade war.

What’s changed?

Back then, it was mostly tariffs and tit-for-tats on steel and soybeans. Today, the landscape is structurally different. We’re seeing:

Escalating export controls on AI chips, semiconductors, and critical technologies

Broad-based sanctions spreading from Russia to China to the Middle East

Currency tensions as countries increasingly de-dollarize trade

Supply chain nationalism where every country is trying to “reshore” its strategic industries

Cross-border capital controls tightening as countries prepare for more fragmentation

This isn’t just a trade war—it’s a geoeconomic cold war, where countries are shifting from cooperation to competition across all domains: tech, currency, energy, even food security.

For bullish investors, this environment is a nightmare. Policy risk is now baked into everything. One headline or TruthSocial post can move entire markets, as we’ve seen. And that’s why safe havens like gold are attracting capital—not just from retail investors, but from governments and institutions who are preparing for a more fractured, uncertain world.

Gold Inflows Have Surged to Record Highs

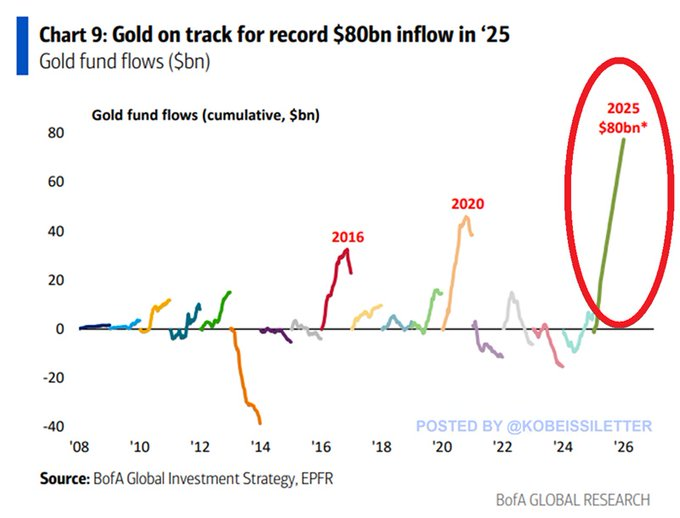

Gold fund inflows have smashed records—$80 billion so far this year, doubling the 2020 pandemic high. This isn't retail panicking into Gold. This is smart money moving in silence, as they have been for the last several months.

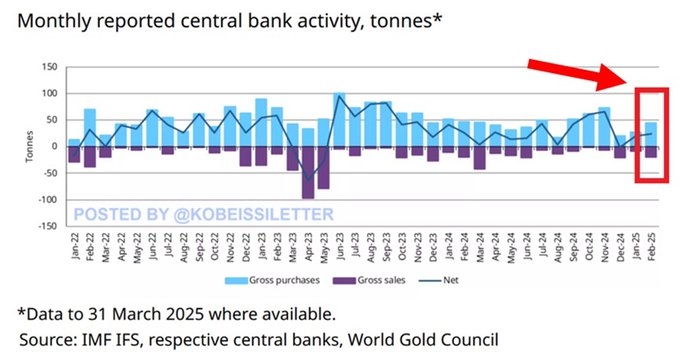

Even central banks are acting differently. In just the last three years, they’ve snapped up over 3,100 tonnes of gold. That’s not a hedge. That’s a repositioning. And it’s happening while they’re telling the public everything’s fine. A “soft landing,” they say—while they quietly hoard hard assets..

And while Wall Street analysts are finally playing catch-up, boosting their gold forecasts, here’s what matters: 42% of fund managers now say gold will be the top-performing asset of 2025. Just last month, that number was 23%.

They’re rotating out of US assets, fast. And 73% say the myth of “US exceptionalism” has peaked. That’s not a small shift. That’s a paradigm crack.

Bottom line? Gold’s rally highlights a growing lack of confidence in traditional investment strategies. While others focus on earnings reports and CPI numbers, the most strategic investors are shifting their assets.

Given the current market conditions, it's crucial to reassess your portfolio. Diversifying into assets like gold (after a drop) could provide stability in the face of economic uncertainty. Keep an eye on bond markets and be cautious with US-based investments, as shifts in global dynamics and policy risk could impact their long-term value.

If you found this helpful, consider subscribing for premium content. The premium letter not only focuses on key recommendations and strategies to profit from the current shifts in the market, but also offers deeper insights into global macro trends, investment opportunities, and contrarian viewpoints. Meanwhile, the free version primarily keeps you informed with the latest news to ensure you're up-to-date.

The next few months will be critical. Stay ahead of the curve.